Mortgage Broker Glendale CA: Helping You Navigate the Home Loan Process

Mortgage Broker Glendale CA: Helping You Navigate the Home Loan Process

Blog Article

How a Home Loan Broker Can Aid You Browse the Intricacies of Home Financing and Car Loan Application Procedures

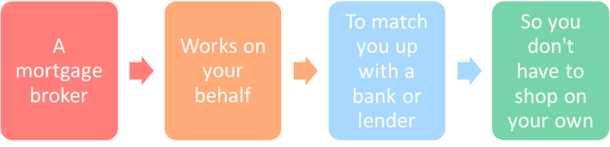

A home mortgage broker offers as an educated intermediary, outfitted to streamline the application process and tailor their approach to specific economic conditions. Recognizing the complete range of exactly how a broker can help in this journey raises important inquiries concerning the subtleties of the procedure and the possible risks to prevent.

Understanding Home Mortgage Brokers

Home mortgage brokers have solid relationships with several loan providers, offering customers accessibility to a wider array of home mortgage items than they could find by themselves. This network allows brokers to negotiate better rates and terms, inevitably profiting the consumer. Additionally, brokers assist clients in collecting needed paperwork, completing application, and guaranteeing conformity with the lending requirements.

Advantages of Making Use Of a Broker

Utilizing a home mortgage broker supplies various benefits that can significantly boost the home funding experience - Mortgage Broker Glendale CA. Among the key benefits is accessibility to a more comprehensive variety of lending items from numerous loan providers. Brokers have extensive networks that enable them to existing choices customized to individual financial circumstances, possibly bring about more competitive rates and terms

Furthermore, home mortgage brokers give important know-how throughout the application procedure. Their expertise of neighborhood market conditions and providing techniques allows them to assist customers in making notified decisions. This competence can be especially helpful in browsing the paperwork demands, guaranteeing that all necessary paperwork is completed properly and sent in a timely manner.

One more advantage is the possibility for time financial savings. Brokers take care of a lot of the legwork, such as gathering details and communicating with lenders, which allows clients to concentrate on other facets of their home-buying trip. Brokers often have developed partnerships with loan providers, which can facilitate smoother arrangements and quicker approvals.

Navigating Financing Choices

Navigating the myriad of lending alternatives offered can be frustrating for lots of homebuyers. With numerous sorts of home loans, such as fixed-rate, adjustable-rate, FHA, and VA lendings, establishing the most effective fit for one's monetary situation calls for careful factor to consider. Each car loan kind has distinct features, advantages, and prospective drawbacks that can substantially affect long-lasting price and financial stability.

A mortgage broker plays a crucial duty in simplifying this procedure by giving customized suggestions based on private conditions. They have access to a broad variety of lenders and can assist buyers contrast various car loan items, ensuring they recognize the terms, rate of interest, and payment frameworks. This specialist insight can expose options that may not be easily noticeable to the average customer, such as niche programs for new purchasers or those with special economic situations.

Moreover, brokers can assist in determining one of the most ideal lending amount and term, lining up with the customer's spending plan and future goals. By leveraging their expertise, homebuyers can make informed decisions, avoid common mistakes, and inevitably, safe financing that straightens with their demands, making the trip towards homeownership much less daunting.

The Application Process

Understanding the application procedure is crucial for potential homebuyers intending to safeguard a mortgage. The home loan application procedure generally starts with celebration required paperwork, such as evidence of income, tax returns, and info on financial debts and properties. A mortgage broker plays a critical duty in this phase, helping clients compile and arrange their monetary records to present a complete picture to loan providers.

When the documents is prepared, the broker submits the application to multiple lenders on behalf of the debtor. This not just simplifies the process but also enables the customer to compare numerous car loan options properly (Mortgage Broker Glendale CA). The lending institution will certainly after find here that perform an extensive review of the application, that includes a debt check and an analysis of the consumer's economic security

Following the initial review, the lender might ask for extra documentation or information. This is where a home loan broker can offer important support, ensuring that all demands are attended to without delay and properly. Ultimately, a well-prepared application increases the chance of approval and can result in more favorable lending terms. By browsing this intricate procedure, a home loan broker helps borrowers prevent prospective pitfalls and accomplish their home funding goals successfully.

Long-term Monetary Assistance

Among the crucial benefits of collaborating with a home mortgage broker is the provision of long-lasting financial assistance tailored to individual situations. Unlike this website standard lenders, home loan brokers take an alternative strategy to their customers' monetary wellness, thinking about not just the immediate finance requirements however additionally future monetary objectives. This tactical preparation is essential for property owners that intend to maintain financial stability and build equity in time.

Home loan brokers analyze numerous factors such as earnings stability, credit rating, and market fads to advise one of the most suitable funding items. They can additionally give suggestions on refinancing options, potential financial investment possibilities, and strategies for debt management. By establishing a long-term relationship, brokers can help clients navigate fluctuations in rates of interest and real estate markets, ensuring that they make informed decisions that line up with their progressing monetary requirements.

Verdict

In final thought, engaging a home loan broker can significantly ease the intricacies associated with home financing and the finance application process. By leveraging their competence, borrowers access to a wider variety of finance items and more helpful hints favorable terms. The broker's role in improving and assisting in arrangements documents enhances the overall effectiveness of getting a home mortgage. Inevitably, the support of a mortgage broker not only simplifies the prompt process but also offers useful long-term financial advice for borrowers.

Mortgage brokers possess solid connections with several lenders, giving customers access to a broader range of home mortgage items than they might find on their own.Furthermore, mortgage brokers provide invaluable guidance throughout the finance application process, helping customers recognize the subtleties of their funding options. In general, a mortgage broker offers as an educated ally, enhancing the home loan experience and boosting the probability of securing desirable car loan terms for their customers.

Unlike traditional lenders, home loan brokers take a holistic method to their customers' financial health and wellness, taking into consideration not only the immediate financing needs yet likewise future economic objectives.In final thought, involving a home loan broker can greatly reduce the complexities connected with home funding and the lending application procedure.

Report this page